What Is a Durable Power of Attorney?

A durable power of attorney document allows one person (the principal) to appoint another (the agent) to make decisions and act on their behalf. The "durable" aspect means that the powers and legal authority granted remain in effect even if the principal becomes incapacitated due to illness, injury, or other reasons.

DPOAs are widely used with other estate planning documents. This option is also beneficial when a person wants to ensure continuity in managing their affairs in case they become unable to do so themselves. It's best to consult with an estate planning lawyer when creating a DPOA to ensure it accurately reflects the principal's wishes and complies with local laws.

What Are the Types of Durable Powers of Attorney?

There are several types of durable power of attorney, each serving different purposes. Let's discuss all of them below.

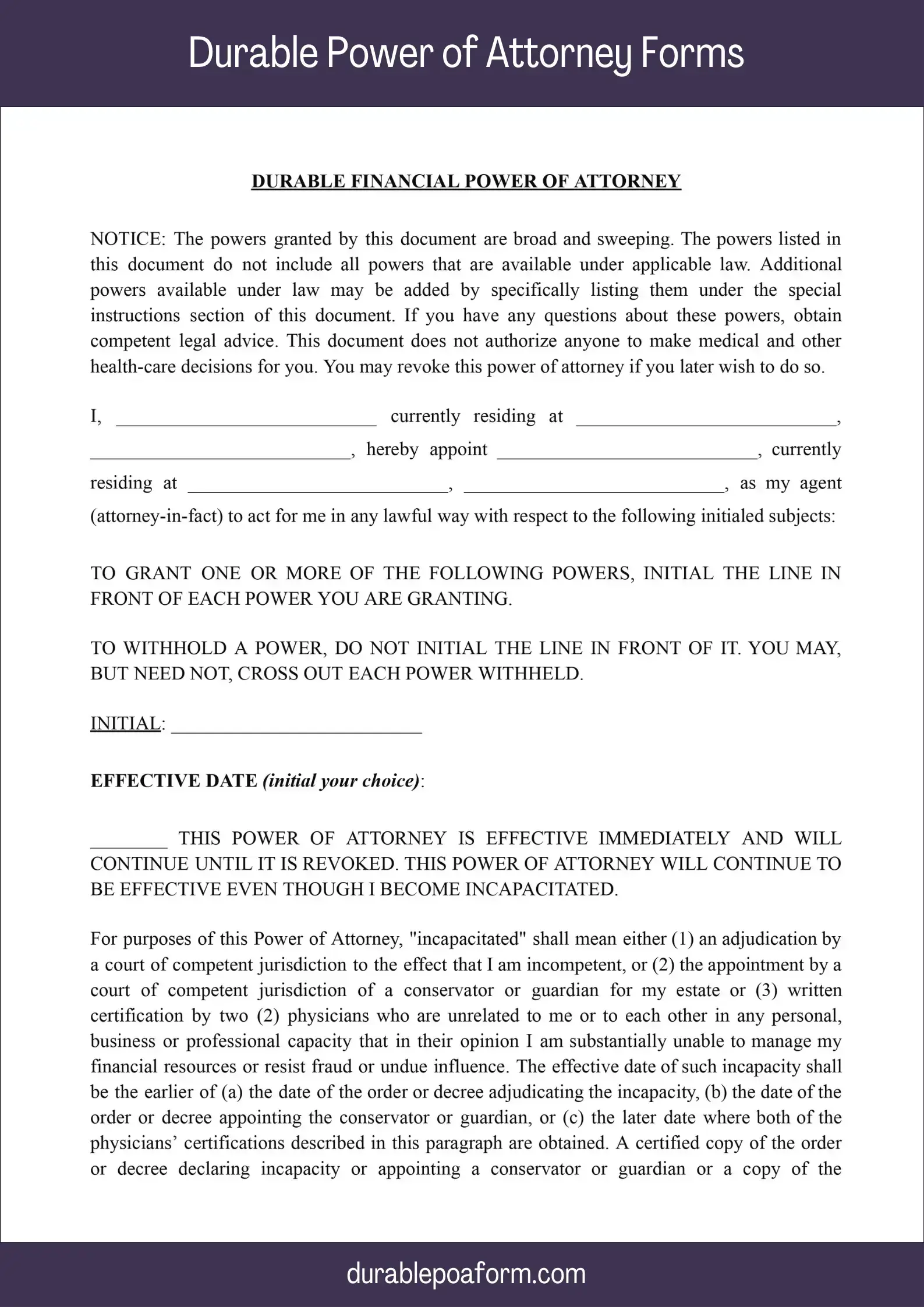

1. Durable Financial Power of Attorney

This type of power of attorney is centered on managing financial affairs. The person appointed, often called the agent or attorney-in-fact, is entrusted with the responsibility to handle financial decisions and actions on behalf of the grantor. Here is a scope of all possible financial powers:

- Handling Bank Accounts. It includes performing financial transactions such as deposits and withdrawals and overseeing the bank-related business.

- Investments. The agent can manage investments and make decisions on finances, like buying or selling stocks, bonds, and other investment vehicles.

- Property Transactions. It involves the authority to buy, sell, manage, or lease real estate and other property.

Such financial POAs become particularly useful when the principal is incapacitated due to illness or cannot manage their financial matters due to absence.

2. Medical Durable Powe of Attorney

The Medical POA authorizes a designated individual to make health care decisions on behalf of the grantor, should they become unable to make such decisions themselves. This type is also called a health care proxy. It ensures that medical care preferences are respected even if the grantor is incapacitated. Below is a scope of the agent's authority in a medical durable power of attorney:

- Medical Treatment Choices. The agent has the authority to make medical decisions about the types of treatment the grantor receives, including surgeries, psychiatric treatment, home health care, and other procedures.

- Life-Support Decisions. In critical situations, the health care agent may decide whether to initiate, withhold, or withdraw life-support measures, following the grantor's wishes or best interests.

For example, in cases where the principal suffers from a condition that impairs their decision-making ability, such as advanced dementia or a coma, the agent contacts health care providers and assumes the role of decision-maker.

3. Springing Durable Power of Attorney

This durable POA form is unique because it becomes effective only under specific circumstances, as outlined in the document. The term "springing" refers to its activation mechanism, which is triggered by predefined events or conditions. This type of POA is designed for individuals who prefer to maintain control over their affairs until a specific event necessitates the transfer of authority.

The range of such durable POA may be broad or narrow, covering financial issues, health care decisions, or both, depending on the grantor's preferences and the terms of the document. The grantor has the flexibility to tailor the scope of authority to their specific needs and concerns.

For example, the POA can be structured to activate upon the principal's diagnosis, such as Alzheimer's disease or another incapacitating condition. The most common trigger is the grantor's incapacity, whether due to an accident, illness, or age-related decline, that leaves them unable to manage their affairs.

4. Limited Durable Power of Attorney

A limited durable POA is tailored to grant authority in a narrowly defined area or for specific tasks. Unlike the broader scopes of general or other durable powers of attorney, this type focuses on particular duties or decisions.

It's a useful legal tool for situations where the grantor needs someone to act on their behalf for a limited purpose or time frame. It may include handling specific transactions, such as selling a property, managing certain investments, or dealing with particular financial institutions. It can sometimes be designated for certain medical care decisions, though this is less common than broader health care POAs.

So, this type of durable power of attorney is often used for a limited period, such as when the principal will be unavailable due to travel or other commitments.

Durable Power of Attorney vs. Living Will

As mentioned above, a durable POA covers various responsibilities, from financial management to health care decisions. Its durability ensures that the appointed agent can act even if the principal is incapacitated, providing a seamless continuation of decision-making.

In contrast, a living will focuses specifically on an individual's health care preferences, particularly regarding end-of-life care. It comes into play when a person cannot communicate their wishes due to illness or incapacity.

Through a living will, one can clearly state their preferences on life-sustaining medical treatments, pain management, and other critical health care decisions. It guides health care providers, ensuring that the therapies administered align with the principal's values and choices.

One of the key differences between these documents lies in their scope and function. A durable POA designates another person to make decisions, covering a broad spectrum of personal matters. In contrast, a living will is an expression of the individual's choices regarding medical treatment, focused solely on health care.

Both a durable power of attorney and a living will are essential in comprehensive personal and health care planning. They ensure an individual's preferences are respected and followed, mainly when they cannot communicate their wishes due to incapacitation. Having both documents in place is often recommended as part of a well-rounded legal and health care plan.

How to Create a Durable POA: Step-by-Step Guide

To create such a power of attorney, you must carefully consider and comply with legal formalities to ensure that the POA accurately reflects the principal's wishes and is legally binding.

1. Consulting with an Estate Planning Attorney

An attorney specializing in estate planning or elder law is equipped to guide you through the intricacies of durable POA. They can help ensure that the document addresses all your financial and medical care needs and adheres to your state's legal requirements.

2. Drafting the Durable POAs

Drafting the DPOA document is the next step once you understand your needs and legal requirements. This stage involves articulating your wishes regarding the extent of the powers you are granting to your agent. Consider various scenarios, such as incapacitation due to illness or absence, and outline how you would like your affairs managed

3. Expressing the Principal's Wishes

The core of a power of attorney lies in accurately expressing the principal's wishes. It's crucial that you, as the grantor, take the time to consider and communicate your preferences and stipulations. This includes decisions about financial management, medical care choices, and any limitations you wish.

4. Notarization and Legal Formalities

Notarization is when a notary public officially certifies the signers' identity, mental capacity, understanding, and willingness to sign the durable power of attorney. Additionally, some states may have other requirements, such as witnesses or specific wording in the document.

Conclusion

In summary, a durable power of attorney is a fundamental tool in managing personal and healthcare affairs, particularly in the unforeseen event of incapacity. Its importance in ensuring that your wishes are respected and carried out cannot be overstated.

It's wise to act now to establish a durable power of attorney, a proactive step that provides you and your loved ones with peace of mind and safeguards your interests for the future.

Related Posts

Explore these links to understand, create, and manage your durable power of attorney effectively, ensuring your financial and medical wishes are protected:

- What Is a Durable Financial Power of Attorney?

- Types of Powers Granted in a Durable Power of Attorney

- Benefits and Role of a Financial Durable Power of Attorney in Estate Planning

- What Is a Medical Durable Power of Attorney?

- Medical Power of Attorney vs. Living Will

- Essential Components of a Medical Power of Attorney

- How to Be a Health Care Agent

- Common Misconceptions About Durable POAs

- General vs. Durable Power of Attorney: Which One to Choose

- Limited vs. Durable Power of Attorney: What's the Difference

- Immediate vs. Springing Durable Power of Attorney

- How to Create a Durable Power of Attorney

- How to Choose an Agent for Durable POA

- Role and Responsibilities of the Agent

- Co-Agents: Pros and Cons

- Common POA Disputes: Issues and Settlement

- Role of Witnesses and Notaries in Durable Power of Attorney

- Revoking a Durable POA: Reasons and Procedure

- How to Modify a Durable Power of Attorney

- Durable POA: Limitations and Boundaries

- Durable Power of Attorney vs. a Guardianship or Conservatorship

- Durable Power of Attorney vs. a Living Will

- Durable Power of Attorney vs. a Trust

- State-Specific Requirements for Durable Power of Attorney

- Witness Requirements for Durable POA

- Does a Durable POA Need to Be Notarized?

- How to Handle Power of Attorney Abuse

- Termination Events in Durable Power of Attorney

- State-Specific Durable POA Restrictions and Limitations

- State-By-State Filing and Recording Procedures